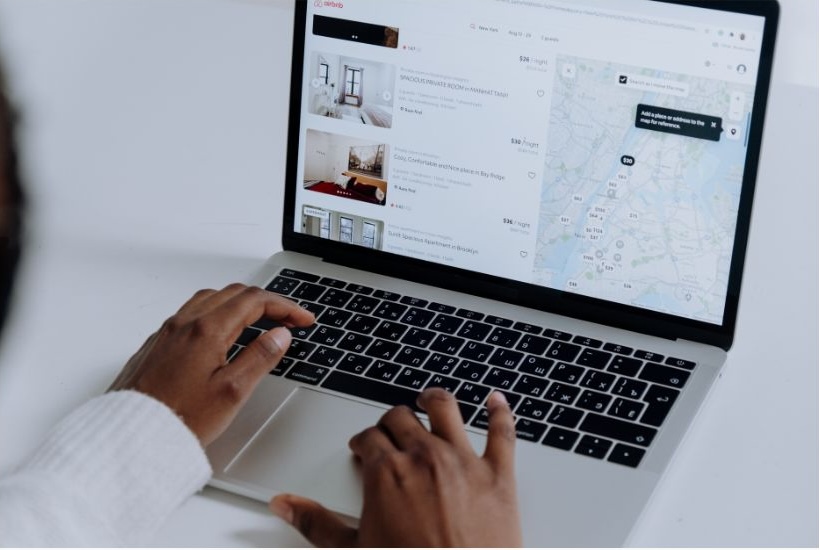

Airbnb and other short-term rental platforms have revolutionized the real estate market, transforming how investors approach property ownership and income generation. What started as a platform for homeowners to rent out spare rooms has evolved into a global phenomenon that offers unique opportunities for real estate investors to maximize returns. Short-term rentals provide flexibility, higher potential income, and diversified investment strategies that appeal to both new and seasoned investors.

However, the role of Airbnb and short-term rentals in real estate investing is complex and comes with its own set of challenges, from regulatory hurdles to market volatility. In this blog, we will explore the benefits and drawbacks of investing in short-term rentals, the strategies for success, and the future outlook of this dynamic segment of real estate.

1. Understanding the Appeal of Short-Term Rentals for Real Estate Investors

Short-term rentals have gained significant traction among real estate investors for several reasons:

- Higher Income Potential: Compared to long-term rentals, short-term rentals often generate higher income on a per-night basis, especially in desirable locations with high tourist demand. This makes them an attractive option for maximizing cash flow.

- Flexibility in Use: Short-term rental properties offer more flexibility. Investors can use the property themselves during periods of low demand or when they need a personal getaway, unlike long-term rentals, which typically require fixed lease agreements.

- Diversification of Investment Portfolio: Investing in short-term rentals allows for diversification in a real estate portfolio, providing a mix of both long-term and short-term income strategies that can help mitigate risks.

- Access to a Global Market: Platforms like Airbnb enable property owners to reach a global audience, increasing occupancy rates and potentially attracting higher-paying guests from international markets.

2. Benefits of Investing in Airbnb and Short-Term Rentals

Short-term rentals present several advantages that make them a compelling choice for real estate investors:

a. Higher Cash Flow and Profit Margins

- Premium Pricing: Short-term rentals can charge premium rates, especially in popular tourist destinations, business hubs, or areas with limited hotel accommodation options. During peak seasons, nightly rates can be significantly higher than what would be earned from a long-term tenant.

- Dynamic Pricing Models: Platforms like Airbnb offer dynamic pricing tools that adjust rates based on demand, local events, seasonality, and competition, optimizing the potential revenue for property owners.

b. Reduced Risk of Tenant Default

- Shorter Rental Periods: With short-term rentals, the risk of tenant default is minimized since guests pay upfront for their stays. This reduces the financial risks associated with non-paying tenants and the potential costs of eviction that are common in long-term rentals.

- Frequent Property Inspections: The high turnover of guests allows for regular inspections and maintenance, ensuring the property remains in good condition. This can prevent long-term damage and reduce maintenance costs over time.

c. Diversification and Scalability

- Flexible Investment Strategy: Investors can start small, perhaps by renting out a single room or a portion of their primary residence, and gradually scale up to multiple properties. This allows for incremental growth without the need for a massive initial investment.

- Portfolio Diversification: By incorporating short-term rentals, investors can diversify their real estate portfolios, balancing between traditional long-term rental properties and higher-yielding short-term options.

d. Opportunity for Value-Add Improvements

- Customization and Upgrades: Unlike long-term rental properties, short-term rentals often allow for more frequent updates and value-add improvements, such as unique interior designs, upgraded amenities, and personalized guest experiences. These improvements can lead to higher occupancy rates and guest satisfaction.

- Higher Potential for Renovation ROI: Upgraded kitchens, bathrooms, outdoor spaces, and even unique themes can attract more guests and justify higher nightly rates, offering a faster return on renovation investments.

3. Challenges of Investing in Short-Term Rentals

While the benefits of short-term rentals are compelling, there are also several challenges that investors need to consider:

a. Regulatory and Legal Hurdles

- Local Regulations and Restrictions: Many cities and municipalities have implemented regulations to control or limit short-term rentals due to concerns over housing shortages, neighborhood disruptions, and tax revenue loss. Investors need to be aware of zoning laws, licensing requirements, and occupancy limits that could affect their ability to operate short-term rentals.

- Compliance and Permits: Securing the necessary permits and complying with local regulations can be complex and costly. Failing to comply with regulations can result in fines, legal disputes, or even property closure.

b. Higher Operating Costs and Management Complexity

- Frequent Turnover and Cleaning Costs: Short-term rentals require more frequent cleaning, maintenance, and guest management than long-term rentals. This can lead to higher operating costs and the need for reliable cleaning and maintenance services.

- Property Management and Time Commitment: Managing a short-term rental involves handling bookings, guest communication, check-ins and check-outs, cleaning schedules, and maintenance requests. Investors may need to hire property management companies, which typically charge 10-30% of rental income, depending on the services provided.

c. Market Volatility and Seasonality

- Fluctuating Demand: Short-term rentals are highly susceptible to market volatility and seasonality. During off-peak seasons or economic downturns, occupancy rates and rental income may decline significantly, affecting profitability.

- Competition with Hotels and Other Rentals: The growing popularity of short-term rentals has led to increased competition with hotels and other short-term rental properties. To stay competitive, investors need to continuously enhance their offerings and differentiate their properties from others.

d. Potential for Negative Guest Experiences

- Guest Behavior and Property Damage: Short-term rentals often host a wide range of guests, and not all may be respectful of the property. Issues such as noise complaints, property damage, or unauthorized parties can lead to costly repairs and potential disputes with neighbors.

- Impact on Reviews and Ratings: Guest reviews and ratings play a crucial role in the success of short-term rentals. Negative experiences can impact a property’s reputation and occupancy rates, making it essential to maintain high standards of service and responsiveness.

4. Strategies for Successful Short-Term Rental Investing

To maximize returns and mitigate risks, investors should consider the following strategies when investing in Airbnb and short-term rentals:

a. Conduct Thorough Market Research

- Understand Local Demand: Research the local market to identify areas with high demand for short-term rentals. Consider factors such as proximity to tourist attractions, business districts, transportation hubs, and event venues.

- Analyze Competition: Study the competition, including nearby hotels and other short-term rentals, to understand pricing strategies, occupancy rates, and guest preferences. This helps in setting competitive rates and identifying potential gaps in the market.

b. Focus on Unique Selling Points (USPs)

- Create a Memorable Experience: To stand out, focus on creating a unique guest experience that goes beyond basic accommodation. This could include themed interiors, luxury amenities, outdoor spaces, or personalized services.

- Offer Value-Added Services: Providing extras like guided tours, local experiences, complimentary breakfast, or concierge services can enhance guest satisfaction and lead to positive reviews and repeat bookings.

c. Optimize Property Listings and Marketing

- High-Quality Photography and Descriptions: Professional photography and detailed descriptions highlighting the property’s unique features and benefits can significantly improve booking rates. A well-crafted listing should showcase the property’s amenities, location advantages, and guest experiences.

- Leverage Multiple Platforms: While Airbnb is the most well-known platform, diversifying across multiple booking platforms such as Vrbo, Booking.com, or HomeAway can help increase visibility and occupancy rates.

d. Implement Dynamic Pricing Strategies

- Use Pricing Tools and Software: Utilize dynamic pricing tools that adjust rates based on demand, competition, and local events. This ensures optimal pricing throughout the year, maximizing revenue during peak times and maintaining occupancy during low seasons.

- Monitor and Adjust Regularly: Regularly review and adjust pricing strategies based on market trends, guest feedback, and competitor analysis to stay competitive.

e. Invest in Professional Property Management

- Consider Hiring a Property Manager: For investors who do not have the time or expertise to manage short-term rentals, hiring a professional property management company can be a worthwhile investment. They handle everything from guest communication and check-ins to cleaning and maintenance, ensuring a seamless experience.

- Ensure High-Quality Maintenance and Cleanliness: Maintaining a clean, well-maintained property is crucial for positive guest reviews and repeat business. Regular maintenance checks and professional cleaning services are essential.

5. The Future of Short-Term Rentals in Real Estate Investing

The future of short-term rentals is likely to be shaped by evolving market dynamics, regulatory landscapes, and technological advancements:

a. Increasing Regulation and Compliance Requirements

- Stricter Regulations: As cities and governments seek to balance housing availability with tourism demand, stricter regulations on short-term rentals are expected. Investors must stay informed about local laws and adapt their strategies accordingly.

- Compliance and Sustainability: Future regulations may focus on sustainability and community impact, requiring investors to adopt eco-friendly practices, noise control measures, and community engagement strategies.

b. Growing Demand for Unique and Experience-Driven Stays

- Experience Economy: Travelers increasingly seek unique, experience-driven stays that offer more than just accommodation. Short-term rental investors can capitalize on this trend by curating themed properties, local experiences, and personalized services.

- Hybrid Models and Co-Living Spaces: The future may see a rise in hybrid models that combine short-term rentals with co-living or co-working spaces, catering to digital nomads, remote workers, and long-stay guests.

c. Integration of Technology and Automation

- Smart Home Integration: The use of smart home technology, such as keyless entry, smart thermostats, and security systems, can enhance the guest experience and streamline property management.

- AI and Automation: Artificial intelligence (AI) and automation tools will play a more prominent role in dynamic pricing, guest communication, and property management, helping investors optimize operations and improve profitability.

Conclusion

Airbnb and short-term rentals have reshaped the landscape of real estate investing, offering lucrative opportunities for those willing to navigate the complexities of the market. While the potential for high returns is undeniable, investors must approach this sector with a well-researched strategy, an understanding of local regulations, and a commitment to providing exceptional guest experiences. By leveraging the right tools, staying adaptable to market changes, and focusing on quality and differentiation, investors can capitalize on the growing demand for unique and flexible short-term rental options.

If there’s anything we can do to support you or if you have any questions about real estate please feel free to reach out to me and my team we would be happy to help you. We love being Sacramento’s real estate resource. Till next time Sacramento!