Buying your first home is a major milestone and a significant financial commitment. For many couples and individuals, this decision often coincides with another life-changing event: starting a family. Balancing the goals of purchasing a home and planning for a baby can be challenging. This blog explores the considerations and strategies for first-time homebuyers navigating the complex choice between securing a mortgage, having a baby, or managing both simultaneously.

1. Understanding the Financial Impact

Before making any decisions, it’s crucial to understand the financial implications of buying a home and having a baby. Both are substantial financial commitments that require careful planning and budgeting.

Mortgage Costs

- Down Payment: Typically, a down payment ranges from 3% to 20% of the home’s purchase price. A larger down payment reduces monthly mortgage payments and can eliminate the need for private mortgage insurance (PMI).

- Monthly Payments: This includes principal, interest, property taxes, and homeowners insurance. It’s important to ensure that monthly payments fit within your budget.

- Closing Costs: These are fees associated with finalizing the mortgage, including appraisal fees, title insurance, and legal fees, which can range from 2% to 5% of the home’s purchase price.

- Maintenance and Repairs: Owning a home comes with ongoing maintenance costs and potential unexpected repairs.

Baby Costs

- Prenatal and Delivery Expenses: Healthcare costs associated with prenatal care, delivery, and postpartum care can be significant, even with insurance coverage.

- Baby Essentials: This includes nursery furniture, clothing, diapers, and feeding supplies. The costs add up quickly, especially during the first year.

- Childcare: Whether you choose daycare, a nanny, or one parent staying home, childcare is a considerable expense.

- Health Insurance: Adding a child to your health insurance plan will increase your premiums.

2. Weighing the Priorities

Deciding whether to prioritize buying a home, starting a family, or doing both requires careful consideration of your personal and financial goals. Here are some factors to consider:

Prioritizing a Mortgage

- Stability: Owning a home provides stability and a sense of permanence. If you plan to start a family soon, having a stable living environment can be beneficial.

- Investment: Real estate can be a good investment, potentially appreciating in value over time and building equity.

- Space: A home provides more space for a growing family compared to most rental properties.

Prioritizing a Baby

- Timing: Biological factors and personal preferences often influence the decision to start a family sooner rather than later.

- Focus: Having a baby requires significant time, energy, and financial resources. Prioritizing this can allow you to focus fully on your growing family without the added stress of homeownership responsibilities.

- Flexibility: Renting can offer more flexibility if you anticipate changes in your family size or job location.

Balancing Both

- Strategic Planning: With careful planning and budgeting, it is possible to manage both a mortgage and a baby. This requires a thorough evaluation of your financial situation and setting realistic expectations.

- Support Systems: Having a strong support network, including family and friends, can provide invaluable assistance, whether it’s with childcare or home maintenance.

3. Creating a Financial Plan

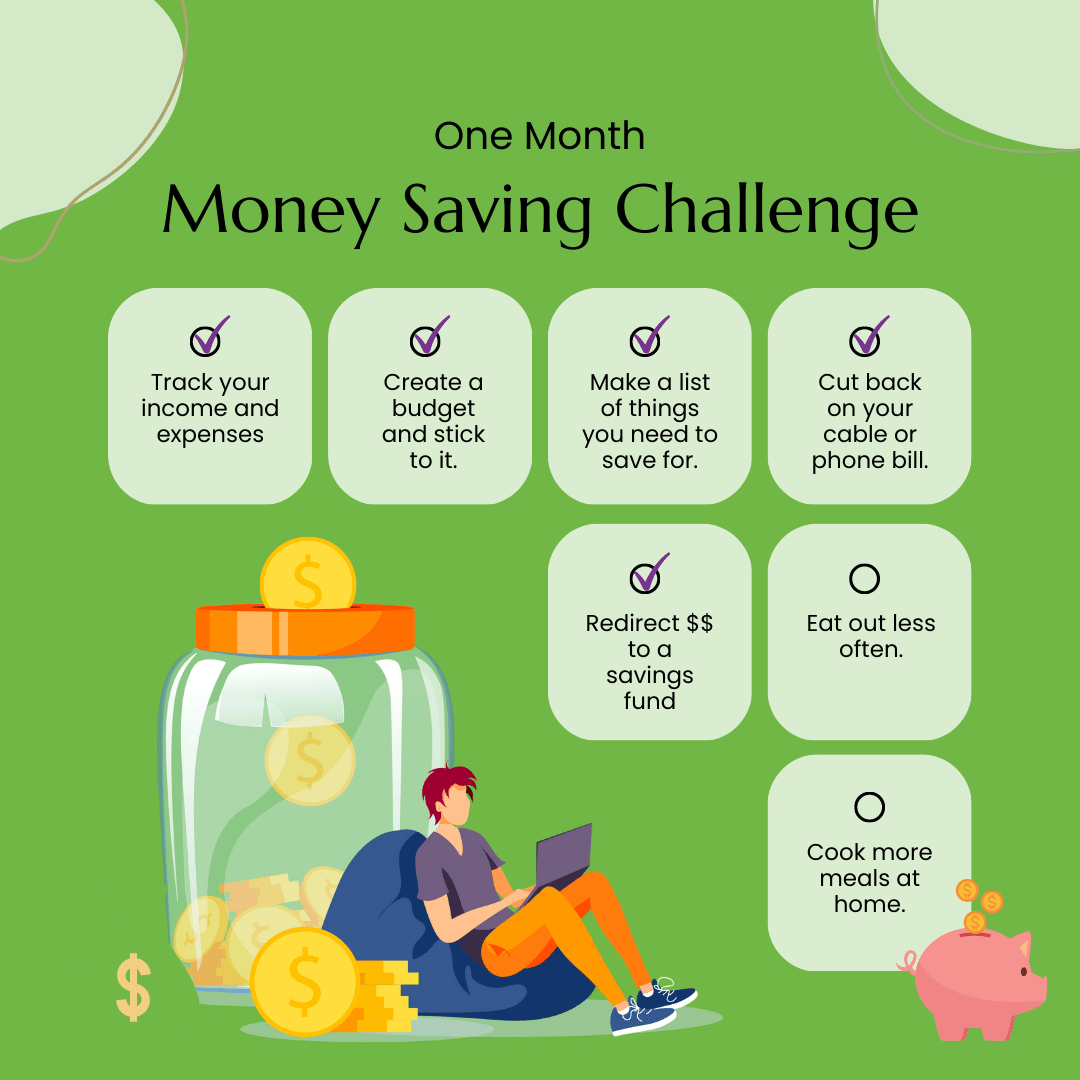

A solid financial plan is essential for navigating the complexities of buying a home and starting a family. Here are some steps to help you get started:

Budgeting

- Detailed Budget: Create a comprehensive budget that includes all potential expenses related to homeownership and having a baby. Track your income and expenditures to identify areas where you can save.

- Emergency Fund: Establish an emergency fund to cover unexpected expenses. This should ideally cover three to six months of living expenses.

Saving

- Down Payment Savings: Start saving for a down payment as early as possible. Consider setting up a dedicated savings account to keep these funds separate.

- Baby Fund: Similarly, set up a separate savings account for baby-related expenses to ensure you are financially prepared for your new arrival.

Debt Management

- Pay Down Debt: Reducing existing debt, such as credit card balances and student loans, can improve your financial stability and increase your chances of mortgage approval.

- Credit Score: Maintain a good credit score by making timely payments and keeping credit card balances low. A higher credit score can qualify you for better mortgage rates.

Insurance

- Life Insurance: Ensure you have adequate life insurance coverage to protect your family’s financial future.

- Health Insurance: Review your health insurance plan to understand coverage for prenatal care, delivery, and pediatric care.

4. Exploring Financial Assistance and Incentives

There are various programs and incentives designed to assist first-time homebuyers and new parents. Research and take advantage of these opportunities:

First-Time Homebuyer Programs

- Federal Programs: Programs such as FHA loans, VA loans, and USDA loans offer favorable terms for first-time buyers, including lower down payment requirements and competitive interest rates.

- State and Local Programs: Many states and municipalities offer grants, down payment assistance, and tax credits for first-time homebuyers.

Parental Leave and Benefits

- Paid Parental Leave: Check if your employer offers paid parental leave or short-term disability benefits that can provide financial support during the initial months after your baby’s birth.

- Tax Benefits: Explore tax deductions and credits available for new parents, such as the Child Tax Credit and Dependent Care Credit.

5. Making the Decision: Mortgage, Baby, or Both?

Ultimately, the decision to buy a home, have a baby, or manage both depends on your unique circumstances, financial situation, and personal goals. Here are some final considerations:

Assess Your Readiness

- Emotional Readiness: Consider your emotional readiness for both homeownership and parenthood. Both require significant time, energy, and commitment.

- Financial Readiness: Conduct a thorough assessment of your financial readiness. Ensure you have a stable income, manageable debt levels, and sufficient savings.

Seek Professional Advice

- Financial Advisor: A financial advisor can help you create a comprehensive plan that aligns with your goals and provides guidance on managing your finances effectively.

- Real Estate Agent: A knowledgeable real estate agent can assist you in navigating the home buying process, finding suitable properties, and understanding market conditions.

- Healthcare Provider: Consult with your healthcare provider to understand the financial and medical aspects of starting a family.

Stay Flexible

- Adaptability: Be prepared to adapt your plans as needed. Life circumstances can change, and it’s important to remain flexible and open to adjustments.

Final Thoughts

Balancing the goals of buying your first home and starting a family can be challenging, but with careful planning and strategic decision-making, it is possible to achieve both. By understanding the financial implications, prioritizing your goals, creating a solid financial plan, and exploring available assistance programs, you can navigate this exciting phase of life with confidence and success. Remember, there is no one-size-fits-all answer, and the best choice is the one that aligns with your unique circumstances and aspirations.

If you are looking to buy your first home or simply wanting to weigh up your option feel free to contact us today!

If you are ready to make the move for that first first home, be sure to choose a home with the best resale value! More on that here!

check out how to handle multiple offers on your home here