Losing a job can be one of the most stressful experiences in life, particularly for homeowners who have the added burden of maintaining mortgage payments and home-related expenses. Financial security during unemployment is crucial, and having an adequate emergency fund can make a significant difference in navigating through tough times. This blog will guide homeowners on how much money they should ideally have in their bank account if they lose their job, covering factors to consider, how to calculate an emergency fund, and strategies to build and maintain it.

Understanding the Importance of an Emergency Fund

An emergency fund acts as a financial safety net, providing a cushion to cover essential living expenses during periods of unemployment or unexpected financial setbacks. For homeowners, this is particularly important due to ongoing expenses like mortgage payments, property taxes, insurance, utilities, and maintenance costs. Without a sufficient emergency fund, homeowners may risk defaulting on their mortgage or going into debt, leading to long-term financial consequences.

Factors to Consider When Calculating an Emergency Fund

Several factors influence the amount of money homeowners should have saved in their emergency fund:

- Monthly Expenses: This includes mortgage payments, property taxes, insurance, utilities, groceries, transportation, healthcare, and other essential costs.

- Job Market and Industry Stability: The likelihood of quickly finding a new job can vary based on your profession, industry, and local job market conditions.

- Family Size and Dependents: Larger families with dependents will have higher monthly expenses and need a larger emergency fund.

- Health and Insurance: Health issues can lead to unexpected medical expenses, and having comprehensive health insurance can impact the size of your emergency fund.

- Debt Obligations: Other debts, such as car loans, student loans, or credit card debt, will require additional financial resources.

How to Calculate Your Emergency Fund

A commonly recommended rule of thumb is to have three to six months’ worth of living expenses saved in an emergency fund. However, for homeowners, aiming for six to twelve months of expenses is often more prudent due to the additional financial responsibilities. Here’s a step-by-step guide to calculate your emergency fund:

- List Monthly Expenses: Calculate all your monthly expenses, including mortgage, utilities, insurance, groceries, transportation, healthcare, debt payments, and other essentials. Example:

- Mortgage: $1,500

- Utilities: $300

- Groceries: $600

- Transportation: $200

- Healthcare: $150

- Insurance: $100

- Debt Payments: $250

- Miscellaneous: $200

- Total Monthly Expenses: $3,300

- Determine Emergency Fund Duration: Decide on the duration you want to cover. For instance, if you choose six months, multiply your total monthly expenses by six.

- Emergency Fund for Six Months: $3,300 * 6 = $19,800

- Adjust for Additional Factors: Consider any additional factors that might increase your required emergency fund, such as higher healthcare costs, the need for longer job search periods, or higher education expenses for children.

Strategies to Build and Maintain an Emergency Fund

Building an emergency fund requires discipline and strategic planning. Here are some effective strategies to help you build and maintain a robust emergency fund:

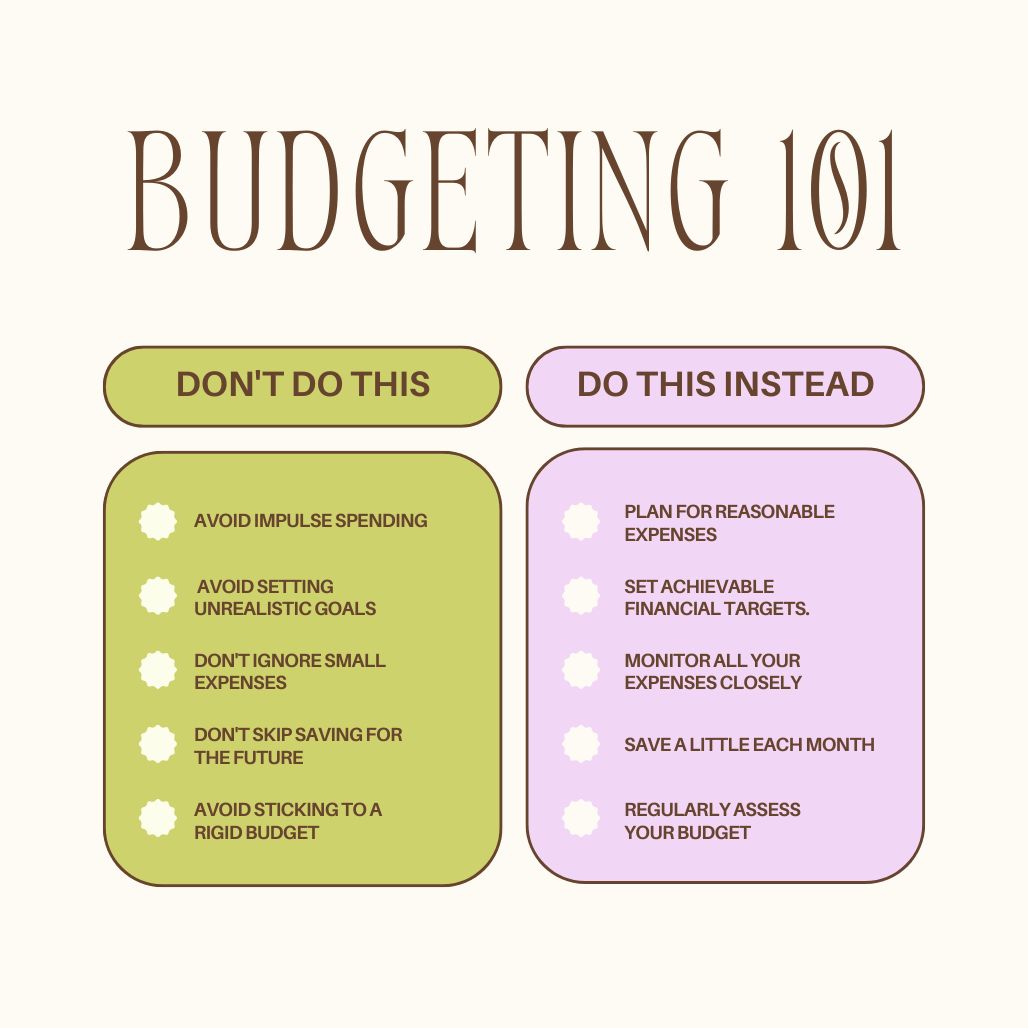

- Create a Budget: A detailed budget helps you track your income and expenses, identify areas where you can cut back, and allocate funds towards your emergency savings.

- Set Savings Goals: Break down your ultimate savings goal into smaller, achievable milestones. For example, aim to save one month’s worth of expenses within the next three months.

- Automate Savings: Set up automatic transfers from your checking account to a dedicated savings account each month to ensure consistent contributions to your emergency fund.

- Reduce Non-Essential Spending: Cut back on discretionary spending, such as dining out, entertainment, and luxury purchases, and redirect those funds towards your emergency savings.

- Increase Income: Consider side hustles, freelance work, or part-time jobs to boost your income and accelerate your savings efforts.

- Utilize Windfalls: Allocate bonuses, tax refunds, or any unexpected financial windfalls directly to your emergency fund.

- Monitor and Adjust: Regularly review your budget and savings progress, and adjust your contributions as necessary to stay on track with your goals.

Maintaining Your Emergency Fund

Once you’ve built your emergency fund, maintaining it is equally important. Here are some tips to ensure your fund remains intact and available when needed:

- Keep It Separate: Store your emergency fund in a separate, easily accessible account, such as a high-yield savings account, to avoid the temptation of using it for non-emergencies.

- Replenish After Use: If you need to dip into your emergency fund, prioritize replenishing it as soon as possible to restore your financial safety net.

- Regularly Reevaluate: Periodically reassess your monthly expenses and adjust your emergency fund target accordingly, especially after major life changes like a new job, moving, or having children.

- Stay Disciplined: Avoid using your emergency fund for non-emergency expenses. Reserve it strictly for situations like job loss, medical emergencies, or major unexpected repairs.

The Psychological Benefits of an Emergency Fund

Beyond financial security, having an emergency fund provides significant psychological benefits. Knowing you have a financial cushion can reduce stress and anxiety, allowing you to focus on finding new employment or managing other challenges without the added pressure of immediate financial worries. This peace of mind can improve your overall well-being and help you make more rational decisions during difficult times.

Real-Life Examples

- Case Study: The Anderson Family: The Andersons, a family of four, had a combined monthly expense of $4,000. By diligently saving and cutting back on non-essential expenses, they built an emergency fund of $24,000, covering six months of expenses. When Mr. Anderson unexpectedly lost his job, the emergency fund allowed them to maintain their mortgage payments and essential living costs without incurring debt. Within five months, Mr. Anderson found a new job, and they were able to replenish their emergency fund over the following year.

- Case Study: Single Homeowner Jane: Jane, a single homeowner with monthly expenses of $2,500, aimed for an emergency fund covering 12 months due to the high volatility in her industry. She managed to save $30,000 over five years by setting aside $500 monthly and using bonuses and tax refunds to boost her savings. When she was laid off, her emergency fund provided a crucial buffer, giving her the time to find a job that matched her skills and salary expectations without compromising her financial stability.

Conclusion

An emergency fund is an essential component of financial planning for homeowners, providing a critical safety net during periods of unemployment or unexpected financial hardships. By carefully calculating your monthly expenses, considering additional factors, and implementing effective savings strategies, you can build and maintain an emergency fund that offers both financial security and peace of mind. Start today by creating a budget, setting savings goals, and prioritizing your financial future. Your efforts will pay off in the long run, ensuring you are well-prepared to handle life’s uncertainties with confidence.

If you are looking to buy your dream home or sell your existing house in Sacramento feel free to get in touch with us today!