Buying a home is a significant milestone that requires careful financial preparation, especially if you’re aiming to make the purchase within the next 12 months. By taking the right steps now, you can ensure that you’re financially ready to make a sound investment. Here’s a comprehensive guide on how to prepare financially for buying a home in the next year.

1. Assess Your Current Financial Situation

Before you start the home-buying process, it’s essential to have a clear understanding of your current financial situation.

Review Your Credit Report and Score

Your credit score is a crucial factor in securing a mortgage with favorable terms. Obtain a copy of your credit report from all three major credit bureaus (Experian, TransUnion, and Equifax) and review it for any errors or inaccuracies. Pay off outstanding debts and make sure to address any negative marks that could lower your score.

Evaluate Your Savings

Determine how much you have saved and how much more you need. Your savings will be used for the down payment, closing costs, and other expenses. Typically, a down payment ranges from 3% to 20% of the home’s purchase price, depending on the loan type.

Analyze Your Debt-to-Income Ratio (DTI)

Lenders look at your DTI ratio to assess your ability to manage monthly payments. Calculate your DTI by dividing your monthly debt payments by your gross monthly income. Aim for a DTI ratio of 36% or lower to improve your chances of mortgage approval.

2. Create a Detailed Budget

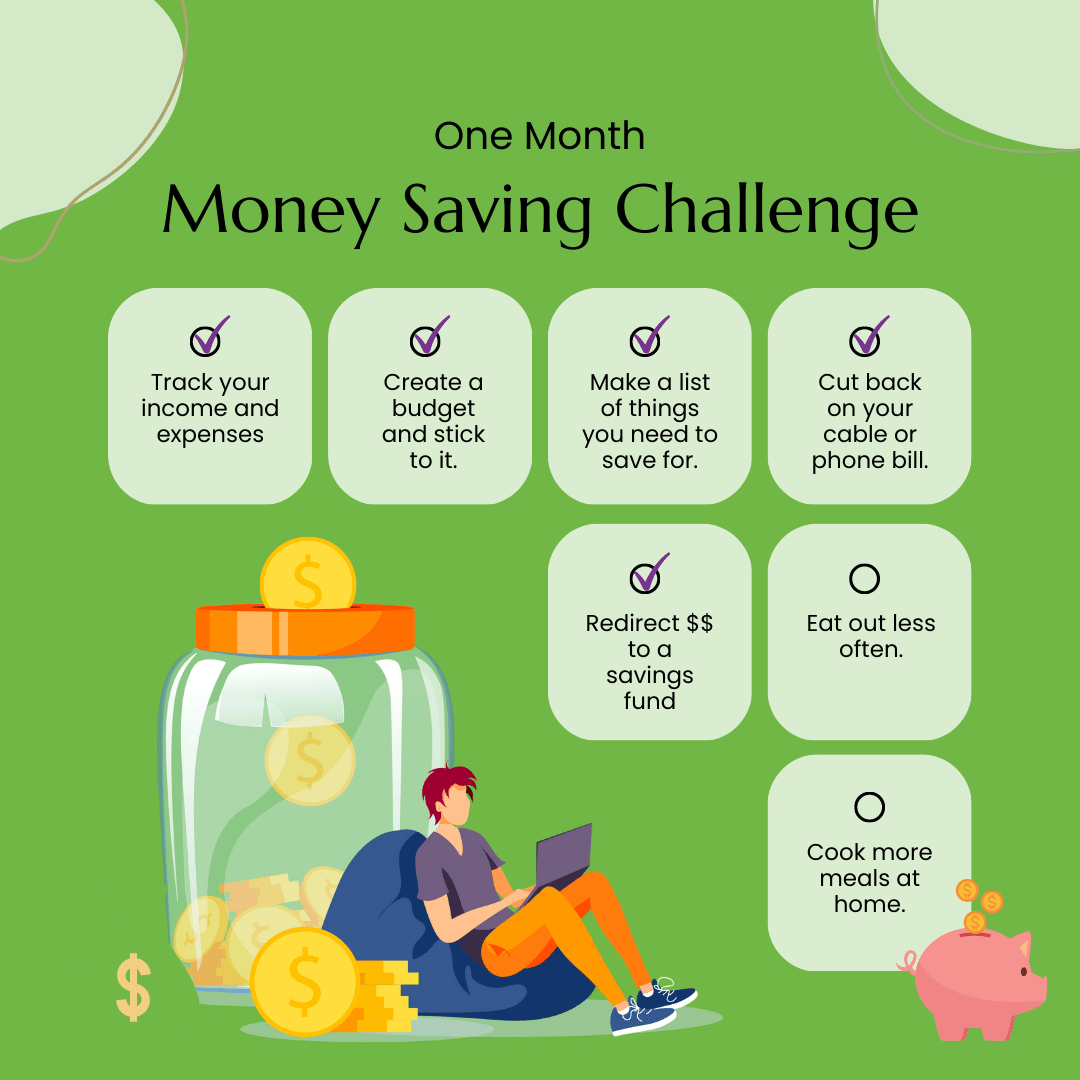

A well-planned budget is essential for managing your finances effectively and saving for your home purchase.

Track Your Income and Expenses

Start by tracking all your income sources and monthly expenses. This will help you identify areas where you can cut back and save more money.

Set Savings Goals

Set realistic savings goals for your down payment, closing costs, and an emergency fund. Automate your savings by setting up a direct deposit into a dedicated savings account.

Reduce Unnecessary Expenses

Identify discretionary expenses that you can reduce or eliminate, such as dining out, subscription services, and luxury purchases. Redirect these funds towards your home savings goal.

3. Save for a Down Payment

The down payment is one of the largest upfront costs when buying a home. Here’s how to save effectively:

Determine Your Down Payment Amount

Decide how much you need to save for your down payment based on the type of mortgage and the price range of homes you’re considering.

Open a Dedicated Savings Account

Open a high-yield savings account specifically for your down payment. This will help you earn interest on your savings while keeping your funds separate from your regular expenses.

Explore Down Payment Assistance Programs

Research down payment assistance programs that may be available to you. These programs can provide grants or low-interest loans to help with your down payment.

4. Plan for Closing Costs

In addition to the down payment, you’ll need to cover closing costs, which typically range from 2% to 5% of the home’s purchase price.

Estimate Your Closing Costs

Work with your real estate agent or lender to get an estimate of the closing costs you’ll need to pay. This includes fees for appraisal, home inspection, title insurance, and other services.

Save for Closing Costs

Include closing costs in your savings plan. Consider setting aside an additional 2% to 5% of the home’s purchase price to cover these expenses.

5. Strengthen Your Financial Profile

Lenders will scrutinize your financial history, so it’s essential to strengthen your financial profile before applying for a mortgage.

Pay Down Debt

Focus on paying down high-interest debt, such as credit cards and personal loans. Reducing your debt will improve your credit score and lower your DTI ratio.

Avoid Major Purchases

Refrain from making large purchases or opening new lines of credit in the months leading up to your home purchase. This can negatively impact your credit score and DTI ratio.

Maintain Steady Employment

Lenders prefer borrowers with stable employment histories. If possible, avoid changing jobs or industries within a year of applying for a mortgage.

6. Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage gives you a clear picture of how much you can afford and shows sellers that you’re a serious buyer.

Gather Necessary Documents

Prepare the necessary documents for mortgage pre-approval, including proof of income, tax returns, bank statements, and information about your debts and assets.

Shop Around for Lenders

Compare mortgage rates and terms from multiple lenders to find the best deal. Consider working with a mortgage broker to help you navigate the process.

Obtain Pre-Approval

Once you’ve chosen a lender, complete the pre-approval process. This will give you a pre-approval letter, which you can use when making offers on homes.

7. Research the Housing Market

Understanding the housing market in your desired area is crucial for making informed decisions.

Study Market Trends

Research home prices, inventory levels, and market trends in the neighborhoods you’re interested in. This will help you determine a realistic budget and timing for your purchase.

Attend Open Houses and Home Tours

Visit open houses and take home tours to get a feel for the types of properties available within your budget. This will also help you refine your list of must-have features.

Work with a Real Estate Agent

Partner with a knowledgeable real estate agent who can guide you through the home-buying process, provide market insights, and help you find properties that meet your criteria.

8. Plan for Additional Costs

Homeownership comes with additional costs beyond the purchase price. Be prepared for these expenses:

Homeowners Insurance

You’ll need to purchase homeowners insurance to protect your investment. Shop around for policies and compare coverage options and premiums.

Property Taxes

Factor in property taxes, which vary by location. Research the property tax rates in your desired area and include them in your budget.

Maintenance and Repairs

Set aside funds for ongoing maintenance and unexpected repairs. A general rule of thumb is to budget 1% to 2% of the home’s purchase price annually for maintenance costs.

9. Build an Emergency Fund

An emergency fund is essential for financial stability, especially as a homeowner.

Aim for 3-6 Months of Expenses

Save enough to cover 3-6 months of living expenses. This fund will provide a financial cushion in case of unexpected events, such as job loss or major repairs.

Keep Your Emergency Fund Accessible

Store your emergency fund in a liquid account, such as a high-yield savings account or a money market account, so you can access it quickly if needed.

10. Monitor Your Progress

Regularly review your financial progress and make adjustments as needed.

Track Your Savings

Keep track of your savings and ensure you’re on target to meet your goals. Use budgeting tools or apps to help you stay organized.

Adjust Your Budget

Periodically review your budget and make adjustments based on changes in your income, expenses, or financial goals. Stay flexible and adapt to new circumstances as they arise.

Stay Motivated

Stay motivated by visualizing your goal of homeownership. Celebrate small milestones along the way to keep yourself on track.

Conclusion

Preparing financially for buying a home in the next 12 months requires careful planning, disciplined saving, and strategic financial management. By following these steps, you can build a strong financial foundation and confidently navigate the home-buying process. Remember, the effort you put in now will pay off when you finally step into your new home, knowing you made a sound and secure investment.

If you are looking to buy your first home feel free to get in touch with us today!