The real estate market can often seem like a maze, especially when trying to identify undervalued properties that promise a good return on investment. With the right knowledge and keen observation, you can spot these hidden gems. This blog will explore key indicators to help you identify an undervalued property and make a smart investment.

1. Understanding Market Value

Before diving into specific indicators, it’s essential to understand what market value is. Market value refers to the estimated amount that a property should sell for on the open market, considering various factors like location, condition, and market trends. An undervalued property is one that is selling below this estimated market value, offering the potential for profit.

2. Researching Comparable Properties

One of the most reliable methods to gauge if a property is undervalued is by researching comparable properties, often referred to as “comps.” These are similar properties in the same area that have recently sold. Look for properties with the same number of bedrooms, bathrooms, and similar square footage. If the property you’re interested in is priced significantly lower than the comps, it might be undervalued.

How to Find Comps:

- Online Real Estate Platforms: Websites like Zillow, Redfin, and Realtor.com offer tools to view recent sales.

- Local Real Estate Agents: Agents have access to the Multiple Listing Service (MLS) and can provide detailed comp reports.

- Public Records: County websites often have records of recent property sales.

3. Evaluating the Property’s Condition

The condition of a property plays a significant role in its valuation. Properties that need repairs or updates might be priced lower to reflect the cost of necessary improvements. While some buyers shy away from fixer-uppers, they can present great opportunities if you’re willing to invest in renovations.

Key Areas to Assess:

- Roof: Check for missing shingles or signs of leaks.

- Foundation: Look for cracks or uneven floors.

- Plumbing and Electrical: Ensure systems are up to code and functioning.

- Interior and Exterior: Assess the need for cosmetic updates like paint, flooring, and landscaping.

4. Location, Location, Location

A property’s location significantly affects its value. Even within the same city, prices can vary dramatically based on neighborhood desirability. An undervalued property might be situated in an up-and-coming area where prices are expected to rise.

Factors Influencing Location Value:

- School Districts: Properties in reputable school districts often command higher prices.

- Crime Rates: Lower crime rates generally correlate with higher property values.

- Amenities: Proximity to parks, shopping centers, and public transportation can enhance a property’s appeal.

- Future Developments: Plans for new infrastructure or commercial developments can indicate future value increases.

5. Analyzing Market Trends

Understanding broader market trends can help you identify undervalued properties. In a buyer’s market, where there are more properties for sale than buyers, prices tend to be lower, increasing the chance of finding a good deal.

Sources for Market Trends:

- Real Estate Reports: Local real estate boards often publish market reports.

- Economic Indicators: Interest rates, employment rates, and GDP growth can influence property prices.

- News Outlets: Stay informed about local and national real estate news.

6. Days on Market (DOM)

The number of days a property has been on the market can be an indicator of its value. Properties that have been listed for an extended period may be undervalued due to a lack of interest or poor marketing. Sellers of such properties might be more willing to negotiate on price.

7. Seller Motivation

Understanding the seller’s motivation can provide insight into whether a property is undervalued. Sellers who need to move quickly due to financial pressure, job relocation, or other personal reasons might price their property lower to ensure a quick sale.

Signs of Motivated Sellers:

- Price Reductions: Multiple price cuts can indicate a seller’s urgency.

- Vacant Properties: Unoccupied homes might signal a seller eager to sell.

- Listing Descriptions: Phrases like “motivated seller” or “must sell” are good indicators.

8. Foreclosures and Short Sales

Foreclosures and short sales are often priced below market value, presenting opportunities for savvy investors. These properties are sold by lenders or distressed homeowners at a discount to recover outstanding loan amounts.

Pros and Cons:

- Pros: Potential for significant savings and high return on investment.

- Cons: These transactions can be complex and time-consuming, often requiring patience and due diligence.

9. Rental Yield Potential

For investors, a good deal isn’t just about the purchase price but also the potential rental income. Calculating the rental yield can help you determine if a property is undervalued and worth investing in.

How to Calculate Rental Yield:

- Gross Rental Yield: (Annual rental income / Property purchase price) x 100

- Net Rental Yield: (Annual rental income – Annual expenses) / Property purchase price x 100

Higher rental yields indicate a better return on investment, making the property a potentially undervalued asset.

10. Property Tax Assessments

Property tax assessments can offer clues about a property’s value. If the assessed value is significantly higher than the asking price, the property might be undervalued. However, be cautious, as tax assessments can sometimes lag behind market values.

11. Networking with Real Estate Professionals

Building a network of real estate professionals, including agents, appraisers, and inspectors, can provide inside information about undervalued properties. These professionals often have access to off-market deals and insights that aren’t publicly available.

12. Attending Property Auctions

Property auctions can be a goldmine for finding undervalued properties. These auctions often feature foreclosures, repossessions, and properties that failed to sell through traditional means. Attending auctions requires preparation and a clear understanding of your budget and the property’s condition.

13. Evaluating Future Potential

Look for properties in areas with potential for future growth. Neighborhoods undergoing revitalization or infrastructure improvements can see significant appreciation over time. Investing in these areas early can yield substantial returns.

14. Seasonal Trends

Real estate markets often have seasonal trends. For example, properties may be undervalued during the winter months when there are fewer buyers. Understanding these trends can help you time your purchase for maximum savings.

15. Reviewing Property Listings Regularly

Staying on top of new listings is crucial. Properties that are priced below market value often sell quickly, so being proactive can help you snag a good deal before others even see it.

16. Assessing Carrying Costs

When evaluating a potentially undervalued property, consider the carrying costs, including taxes, insurance, maintenance, and any necessary repairs. A property with low carrying costs relative to its purchase price might be a better deal than it initially appears.

17. Checking Zoning Regulations

Understanding the zoning regulations can reveal hidden potential in a property. For example, a single-family home in an area zoned for multi-family units could be converted into a duplex, increasing its value.

18. Investigating Previous Sale Prices

Researching the property’s sales history can provide insight into its current value. If the property is selling for significantly less than its previous sale price without a clear reason, it might be undervalued.

19. Understanding Supply and Demand

High supply and low demand in a specific market can lead to undervalued properties. Monitoring these dynamics can help you identify when and where to buy.

20. Evaluating Lifestyle Changes and Trends

Changes in lifestyle preferences, such as a shift towards remote work, can impact property values. Properties in suburban or rural areas might be undervalued as more people look for homes with office space and outdoor amenities.

Conclusion

Spotting a good deal in real estate requires a combination of market knowledge, diligent research, and a keen eye for detail. By understanding the key indicators of an undervalued property—such as market value, property condition, location, and seller motivation—you can make informed decisions and secure profitable investments. Always remember to do your due diligence and consider working with real estate professionals to navigate the complexities of the market. With these strategies in hand, you’ll be well on your way to identifying and capitalizing on undervalued properties.

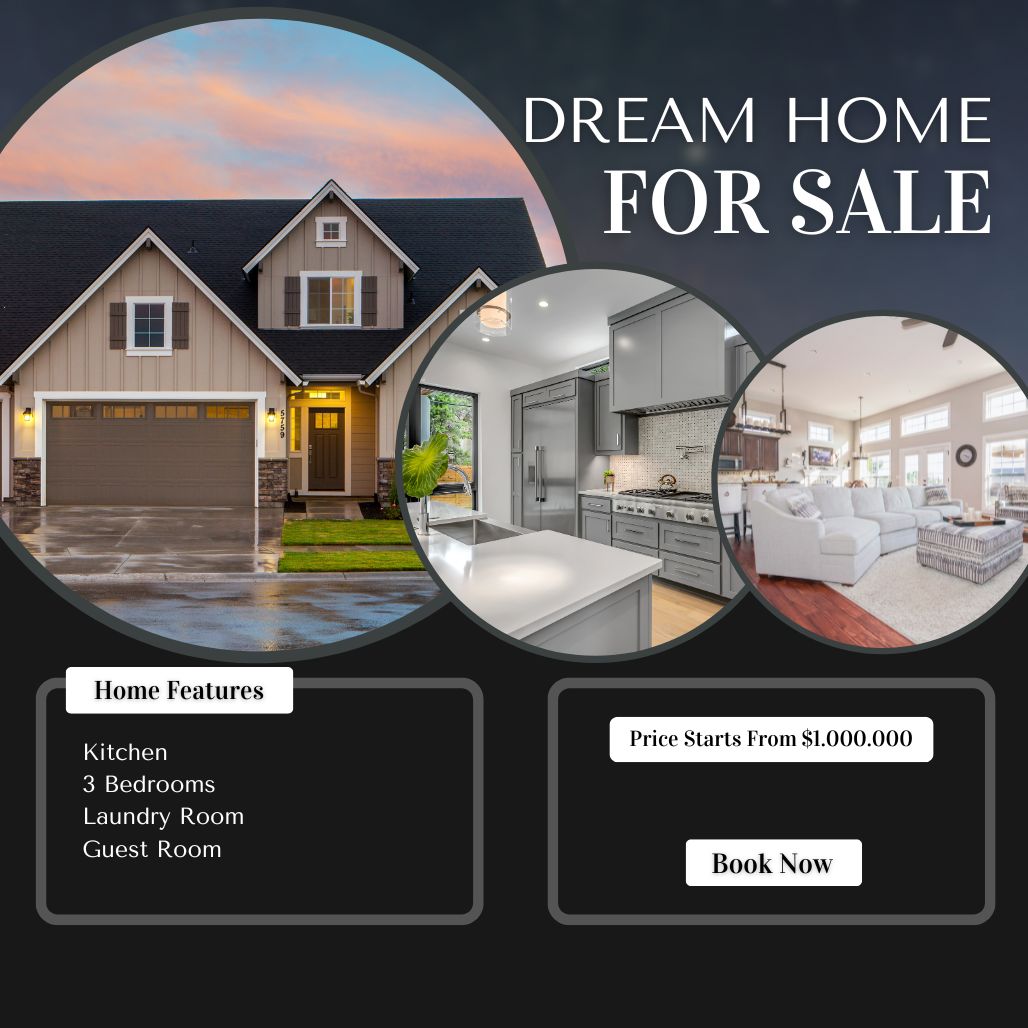

If you are looking to buy your dream home or sell your existing house in Sacramento feel free to get in touch with us today!