In today’s world, many people work diligently, earn respectable incomes, yet find themselves unable to afford a home. This phenomenon, which seems paradoxical given their financial status, has become increasingly common. Understanding the reasons behind this and exploring potential solutions is essential for those caught in this frustrating situation.

The Middle-Class Housing Dilemma

The traditional dream of homeownership has become elusive for many middle-class individuals and families. Despite good salaries, the goal of owning a home often feels out of reach. Let’s delve into the various factors contributing to this challenge.

Rising Housing Costs

One of the most significant barriers to homeownership is the skyrocketing cost of housing. Over the past few decades, home prices have increased dramatically in many regions. Urban areas, in particular, have seen a steep rise in property values, driven by high demand and limited supply. Even those earning above-average incomes can struggle to save enough for a down payment or qualify for a mortgage in such a market.

The Supply and Demand Imbalance

The housing market operates on the basic economic principle of supply and demand. In many desirable locations, the supply of homes has not kept pace with demand. Factors such as restrictive zoning laws, limited land availability, and a slow rate of new construction contribute to this imbalance. As a result, prices soar, and affordability plummets.

Impact of Inflation

Inflation affects every aspect of the economy, including housing. Construction materials, labor costs, and land prices have all risen due to inflation. These increased costs are passed on to homebuyers, making homes more expensive. While wages may also rise with inflation, they often do not keep pace with the rapidly increasing cost of housing.

Stagnant Wages

While the cost of living continues to climb, wage growth has not kept up. Many individuals find that their salaries, despite being higher than the national average, do not stretch far enough to cover the rising expenses associated with homeownership. Stagnant wages mean that even well-paid workers may struggle to save for a down payment or manage the ongoing costs of owning a home.

The Gig Economy and Job Insecurity

The rise of the gig economy and an increase in non-traditional employment arrangements contribute to wage stagnation and financial instability. Many people, especially younger generations, work in freelance or contract positions that may pay well but do not offer the security and benefits of traditional full-time employment. This instability can make it challenging to secure a mortgage and plan for long-term financial goals like homeownership.

High Debt Levels

Another significant factor preventing many from affording a home is high levels of personal debt. Student loans, credit card debt, and car loans can all eat into disposable income, making it difficult to save for a down payment or afford monthly mortgage payments. The burden of debt can be particularly heavy for younger individuals, who may be paying off substantial student loans.

Student Loan Debt Crisis

The student loan debt crisis has reached unprecedented levels, with millions of borrowers owing trillions of dollars. For many, monthly student loan payments consume a significant portion of their income, leaving little room for savings. The impact of student loan debt on credit scores and debt-to-income ratios can also make it more challenging to qualify for a mortgage.

Credit Card and Consumer Debt

Credit card debt and other forms of consumer debt further exacerbate the financial strain. High-interest rates on credit card balances can lead to a cycle of debt that is difficult to escape. The necessity of using credit for everyday expenses can indicate underlying financial instability, making homeownership even more elusive.

Stricter Mortgage Lending Standards

In the wake of the 2008 financial crisis, mortgage lending standards have become more stringent. While these measures were necessary to prevent a repeat of the crisis, they have also made it more difficult for many to qualify for a mortgage. Higher credit score requirements, larger down payments, and more rigorous income verification processes can all pose obstacles for prospective homebuyers.

Down Payment Challenges

One of the most significant hurdles for many potential homebuyers is saving for a down payment. In high-cost areas, the amount needed for a down payment can be substantial. For example, a 20% down payment on a $500,000 home is $100,000, a daunting amount for many to save. Without assistance from family or access to special loan programs, accumulating such a sum can seem nearly impossible.

The Role of Credit Scores

Credit scores play a crucial role in mortgage approval and the terms offered by lenders. Many people, despite earning good incomes, may have credit scores that are lower than required for the best mortgage rates. Factors such as high debt levels, missed payments, or a lack of credit history can all negatively impact credit scores, making it more difficult to secure a mortgage with favorable terms.

The Cost of Living and Hidden Expenses

The overall cost of living has increased significantly in many areas, further stretching household budgets. Housing is not the only expense that has risen; healthcare, childcare, transportation, and utilities have all become more expensive. These hidden expenses can quickly add up, making it challenging to save for a home.

Healthcare Costs

Healthcare costs have risen dramatically, consuming a more significant portion of household incomes. Even with good insurance, out-of-pocket expenses for medical care can be substantial. Unexpected medical bills can derail savings plans and contribute to financial stress.

Childcare Expenses

For families with young children, childcare costs can be a significant financial burden. In many areas, the cost of childcare rivals that of rent or mortgage payments. These expenses can make it challenging to save for a home or afford higher housing costs.

Possible Solutions and Strategies

Despite these challenges, there are strategies and solutions that can help individuals and families move closer to homeownership. While the journey may be difficult, it is not impossible. Here are some approaches to consider:

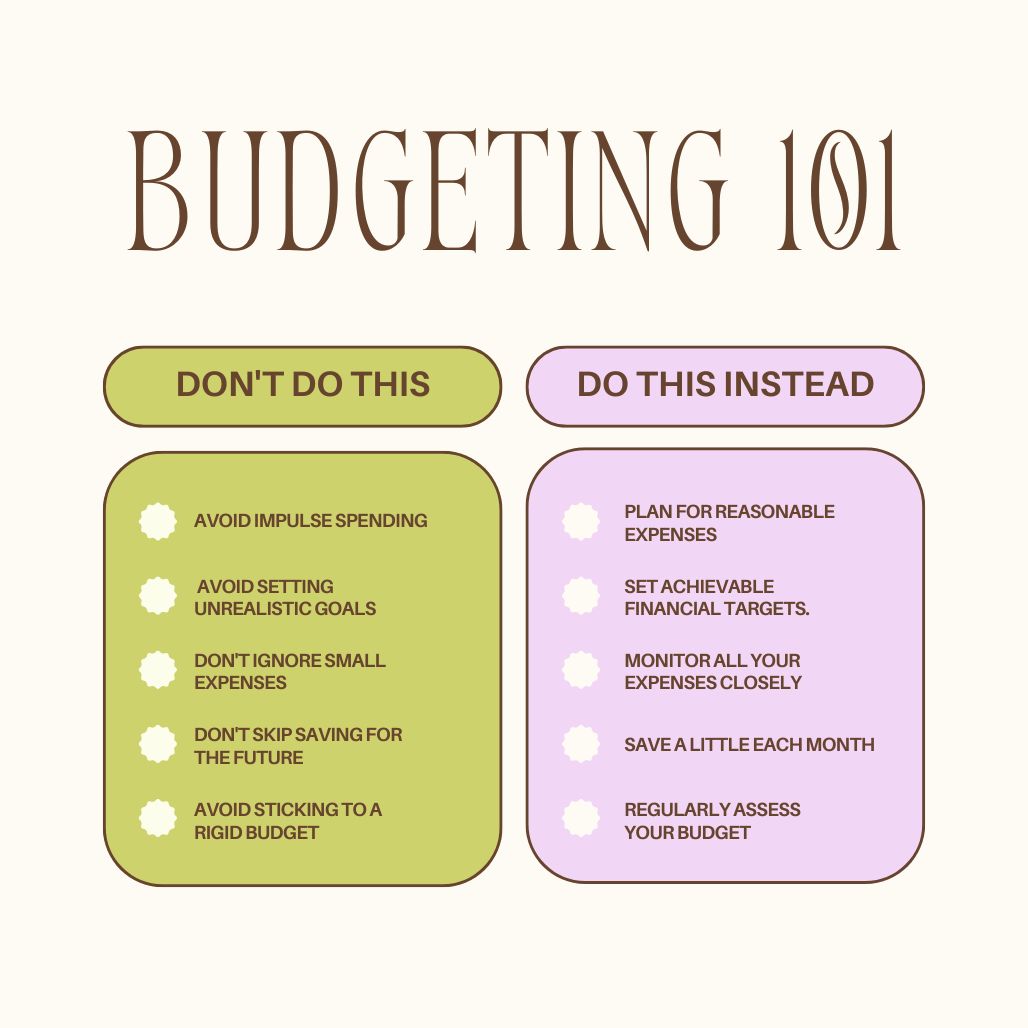

Budgeting and Financial Planning

Creating a detailed budget and financial plan is essential. By tracking income and expenses, identifying areas for savings, and setting realistic financial goals, individuals can improve their financial health and move closer to homeownership. Financial advisors can provide valuable guidance and help create a plan tailored to individual circumstances.

Reducing Debt

Focusing on reducing high-interest debt can free up more income for savings and improve credit scores. Strategies such as debt consolidation, negotiating lower interest rates, and prioritizing debt repayment can help individuals regain control of their finances.

Exploring Assistance Programs

Many local, state, and federal programs exist to help first-time homebuyers. These programs can offer down payment assistance, lower interest rates, or more lenient lending standards. Researching and applying for these programs can provide much-needed support on the path to homeownership.

Considering Alternative Housing Options

Exploring alternative housing options can also be a viable strategy. This might include looking at homes in less expensive neighborhoods, considering fixer-uppers that can be improved over time, or exploring shared housing arrangements. Being flexible and open to different possibilities can increase the chances of finding an affordable home.

Starting a Side Hustle

As discussed earlier, starting a side hustle can provide additional income to help save for a home. Many people find that a side gig can significantly boost their savings and improve their financial situation. Whether it’s freelancing, selling products online, or offering services in your community, a side hustle can make a difference.

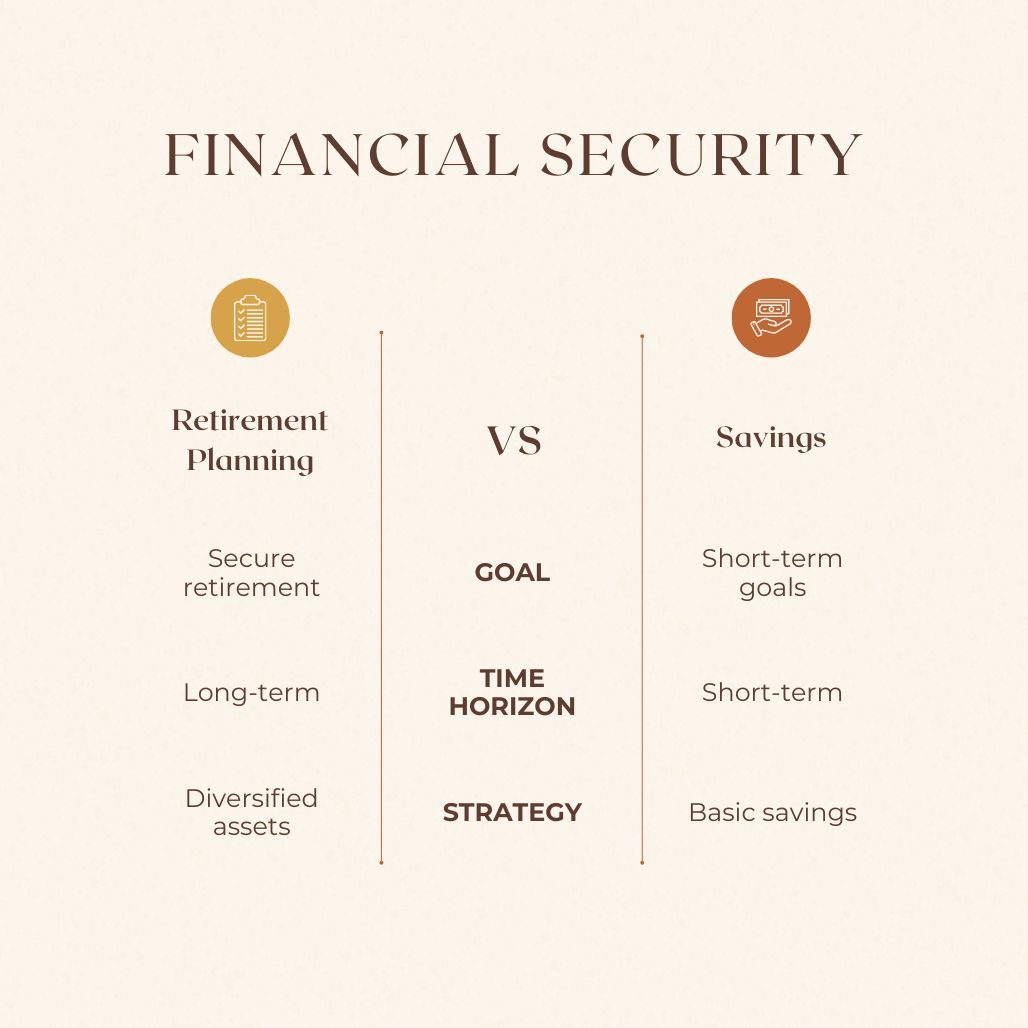

Long-Term Financial Strategies

For those unable to afford a home in the short term, long-term financial strategies can help. This might include investing in retirement accounts, building a robust emergency fund, and planning for future income growth. While these strategies may not provide immediate relief, they can set the stage for future homeownership.

Final Thoughts

Working hard and earning a good income should, in theory, pave the way to homeownership. However, the reality for many is that despite their best efforts, they find themselves unable to afford a home. Rising housing costs, stagnant wages, high debt levels, and stricter lending standards all contribute to this dilemma.

Understanding these challenges and exploring potential solutions is crucial. By taking proactive steps, seeking financial advice, and considering alternative strategies, individuals and families can improve their financial health and move closer to achieving the dream of homeownership. While the journey may be difficult, persistence, planning, and creativity can make a significant difference.

If you are looking to buy your first home feel free to get in touch with us!